20-24 November 2023

We received 75 responses to the first Āpōpō Member Sentiment survey which was live for one week between 20-24 November. This was the first pulse survey looking at how our members feel about their industry. The survey will run on a quarterly basis for Āpōpō members only.

There were a mixture of industries and experience levels of those who responded.

The winner of the $50 Countdown voucher prize draw has been advised and their voucher will be with them before Christmas.

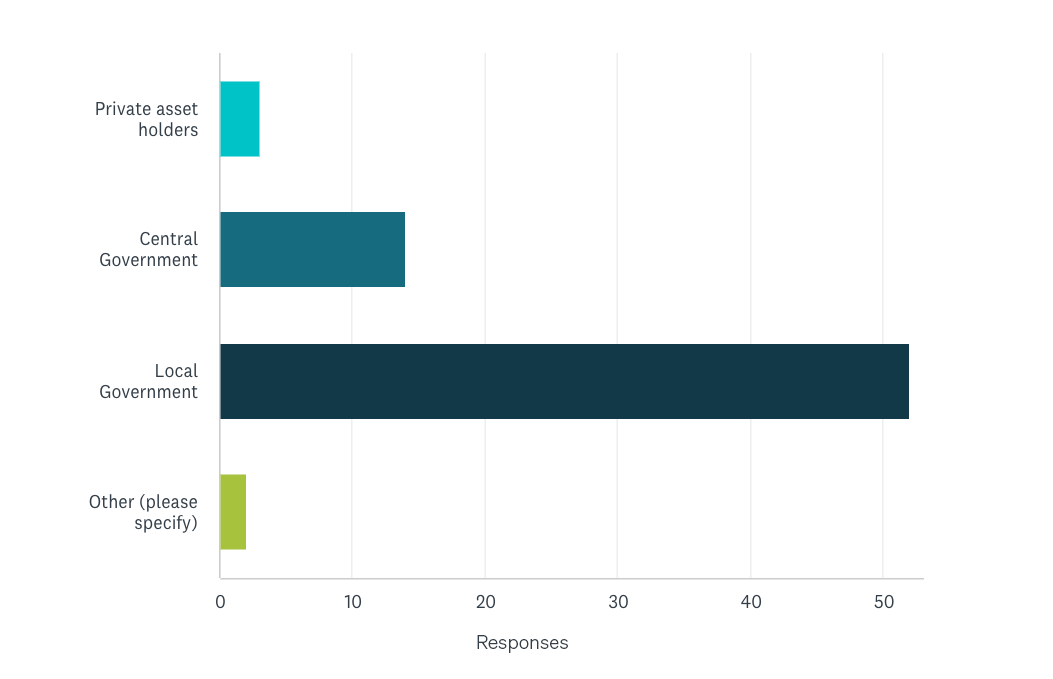

Who responded?

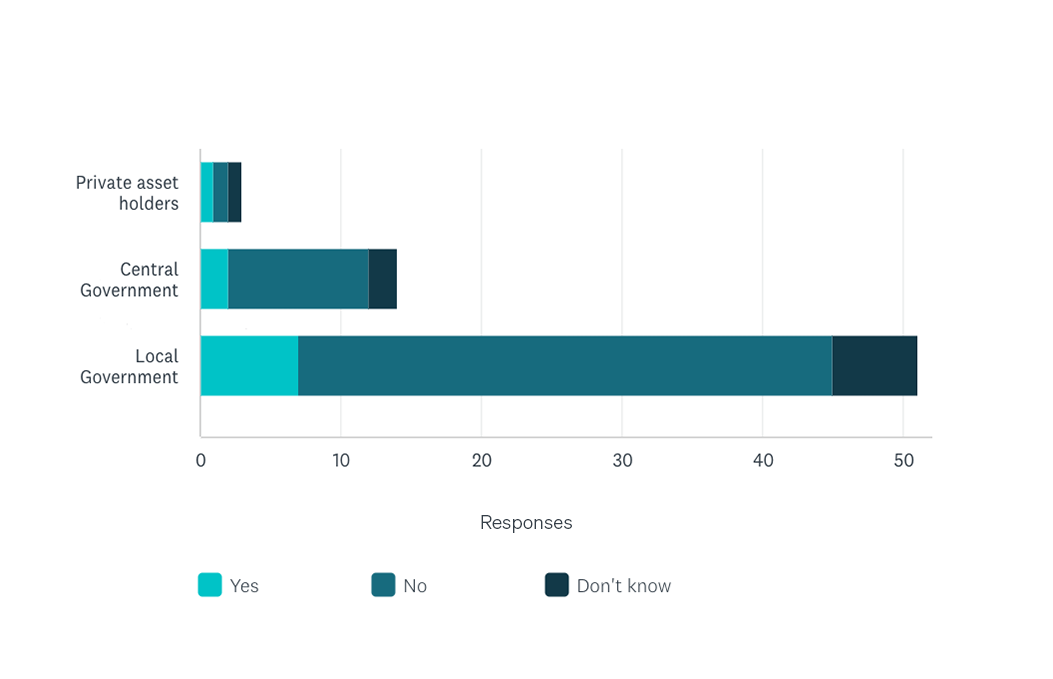

Of the 75 respondents, a majority worked for Local Government (75%), with 20% in Central Government, and 5% working for private asset holders. This is unsurprising particularly given the makeup of our membership and infrastructure asset ownership in Aotearoa.

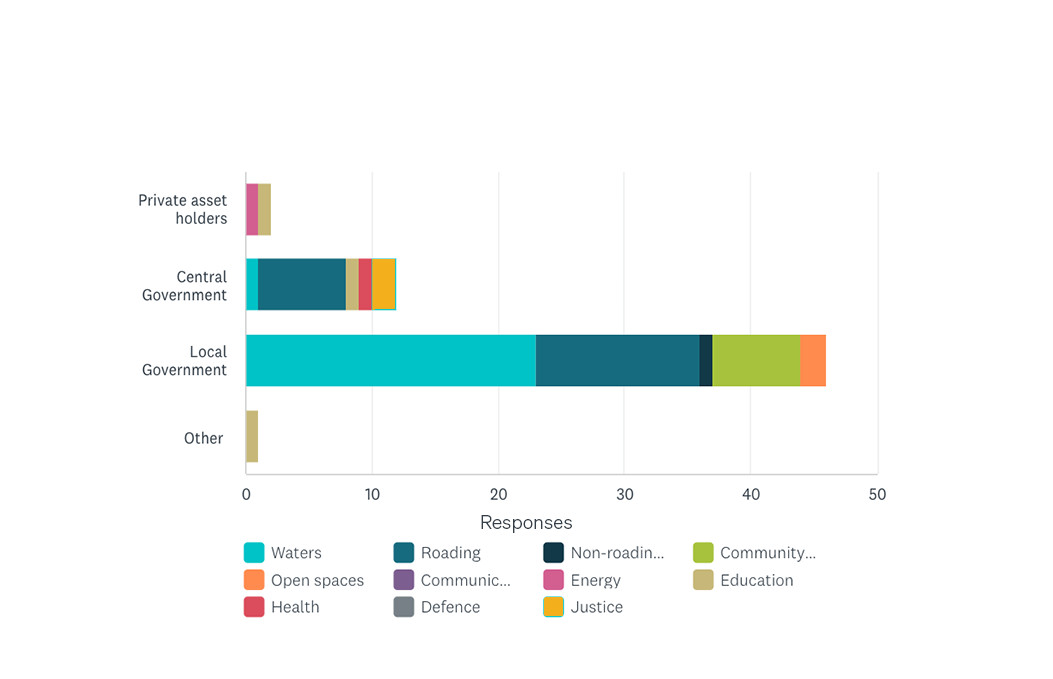

The infrastructure asset management work I do is mainly for:

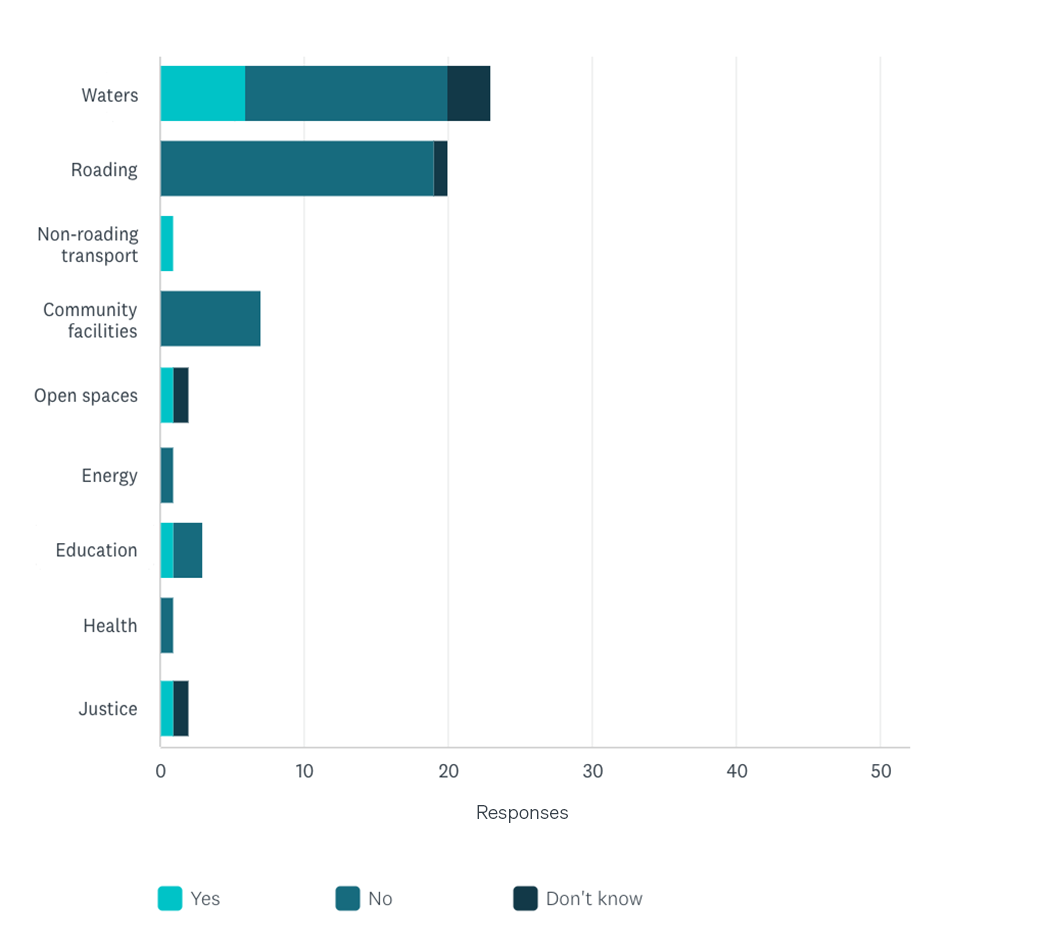

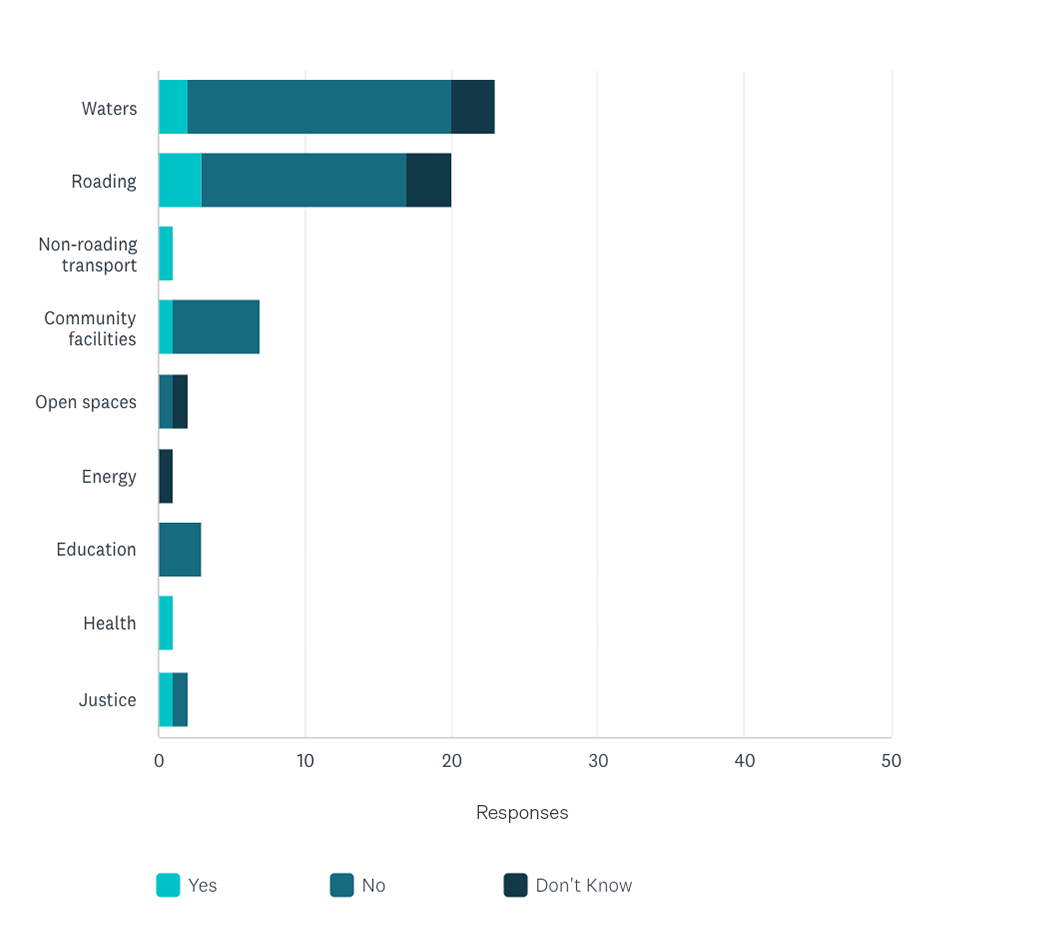

A majority of those working in Central Government work in roading. Water makes up the biggest proportion of those working in Local Government, with roading next, then community facilities.

The infrastructure asset management work I do is mainly for:

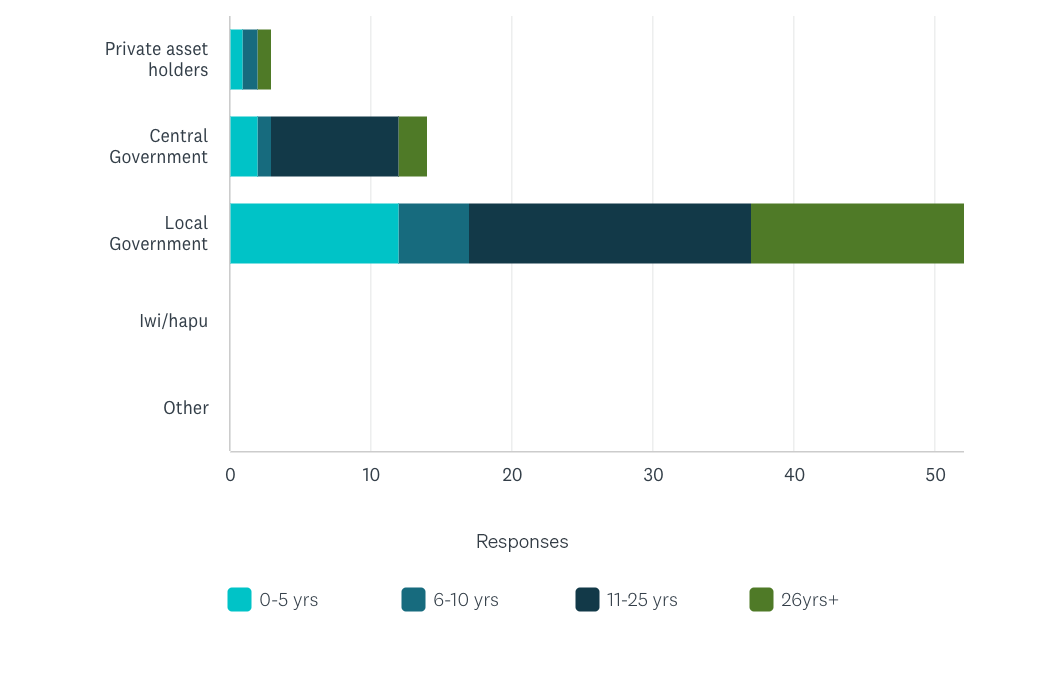

In terms of years of experience in infrastructure asset management, a majority of the respondents had 11-25 years of experience, and all of them worked in government (both central and local). 69% of these respondents worked in Local Government with the remaining 31% in Central Government.

Your experience in infrastructure asset management

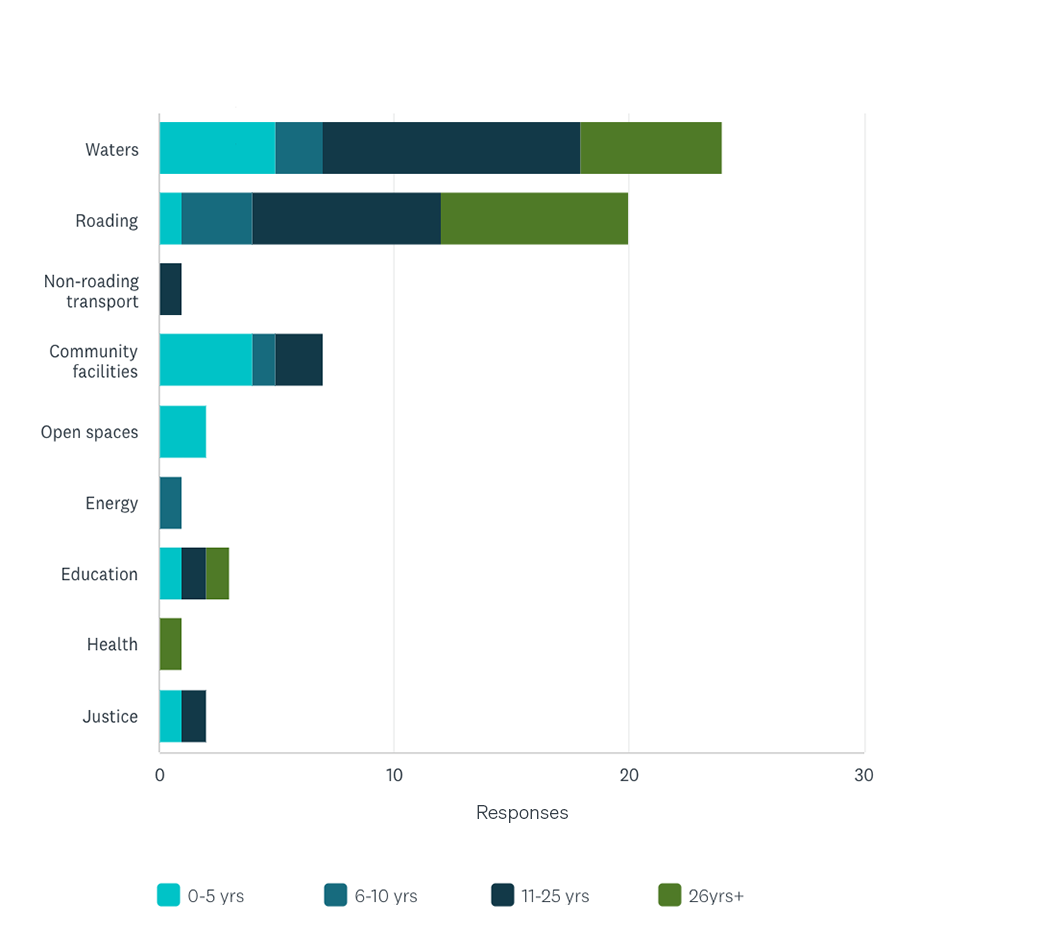

Most respondents working in open spaces and parks had less than 5 years of experience.

Your experience in infrastructure asset management

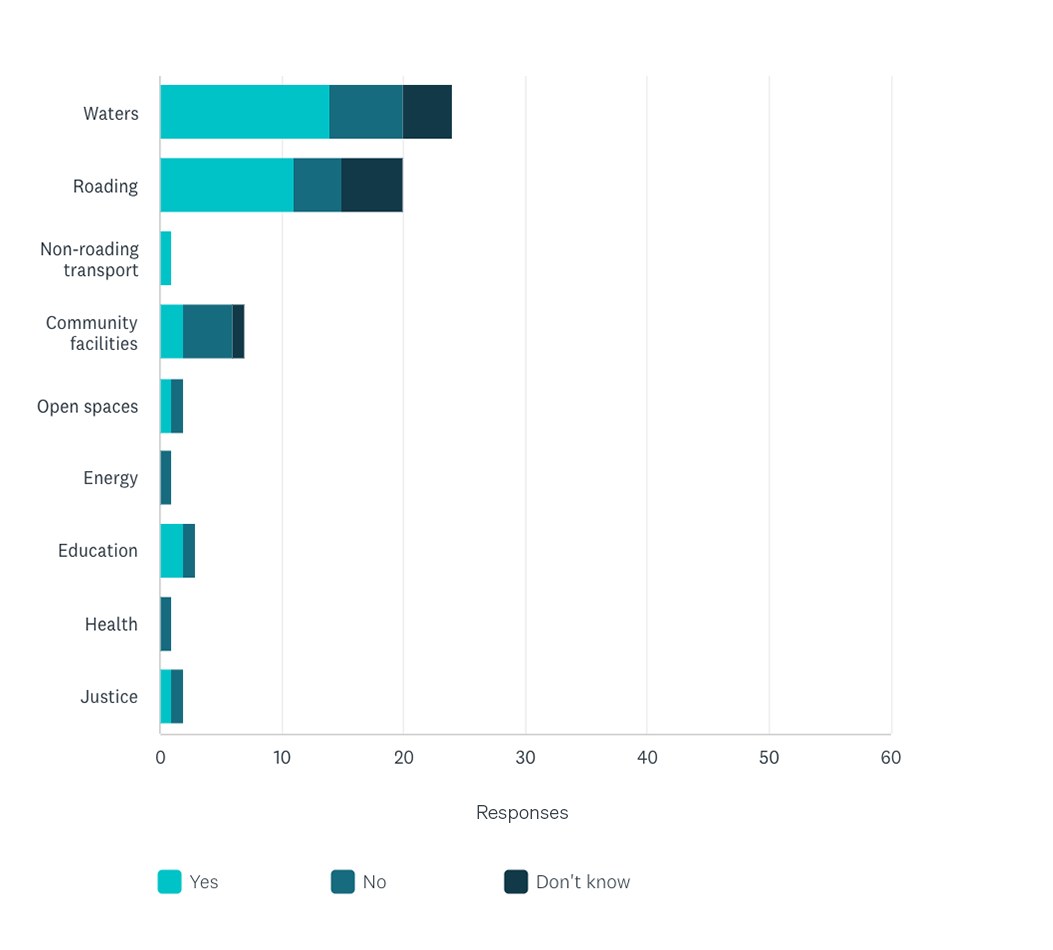

Has New Zealand’s infrastructure improved in the last year?

72% of respondents said no, 15% said yes.

Those in the water industry were more optimistic, with 26% of respondents saying yes and 60% no. In the roading industry no one responded yes. All those working in community facilities, energy and health also responded no or don’t know.

Do you think New Zealand’s infrastructure assets have improved over the past 1 year?

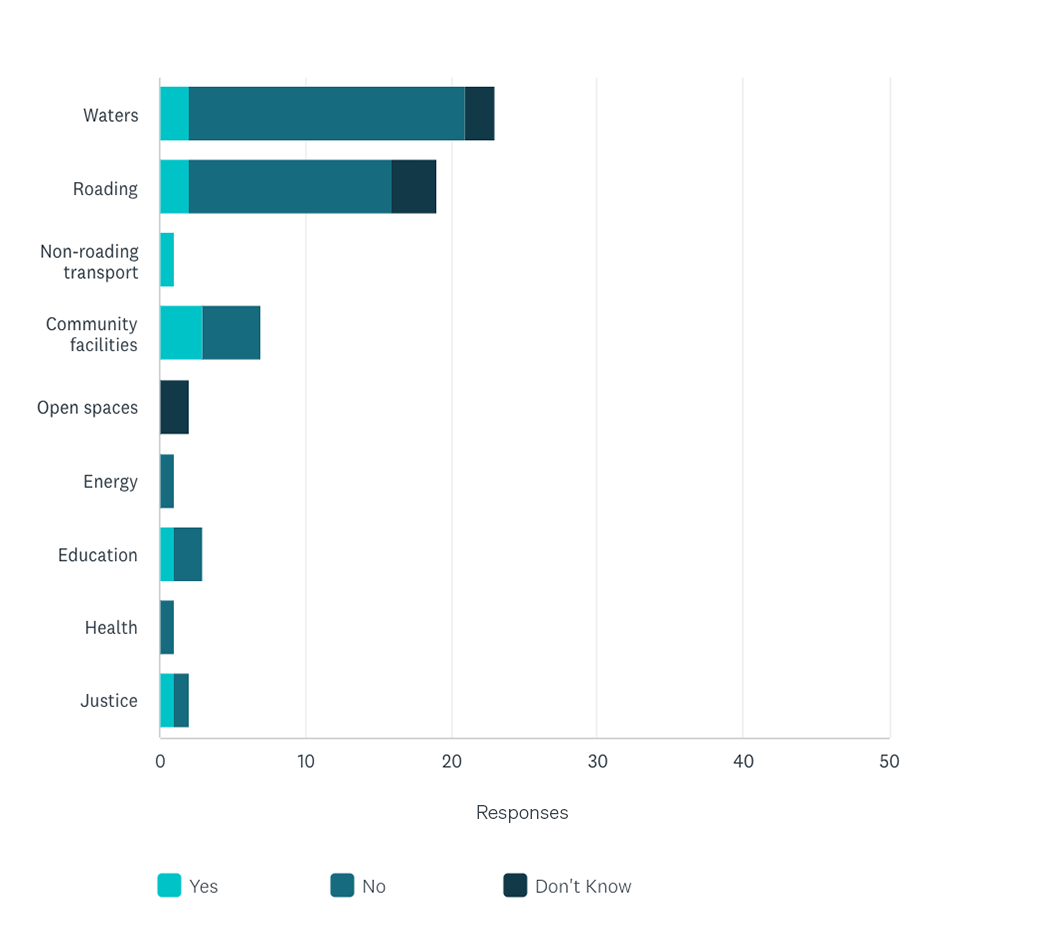

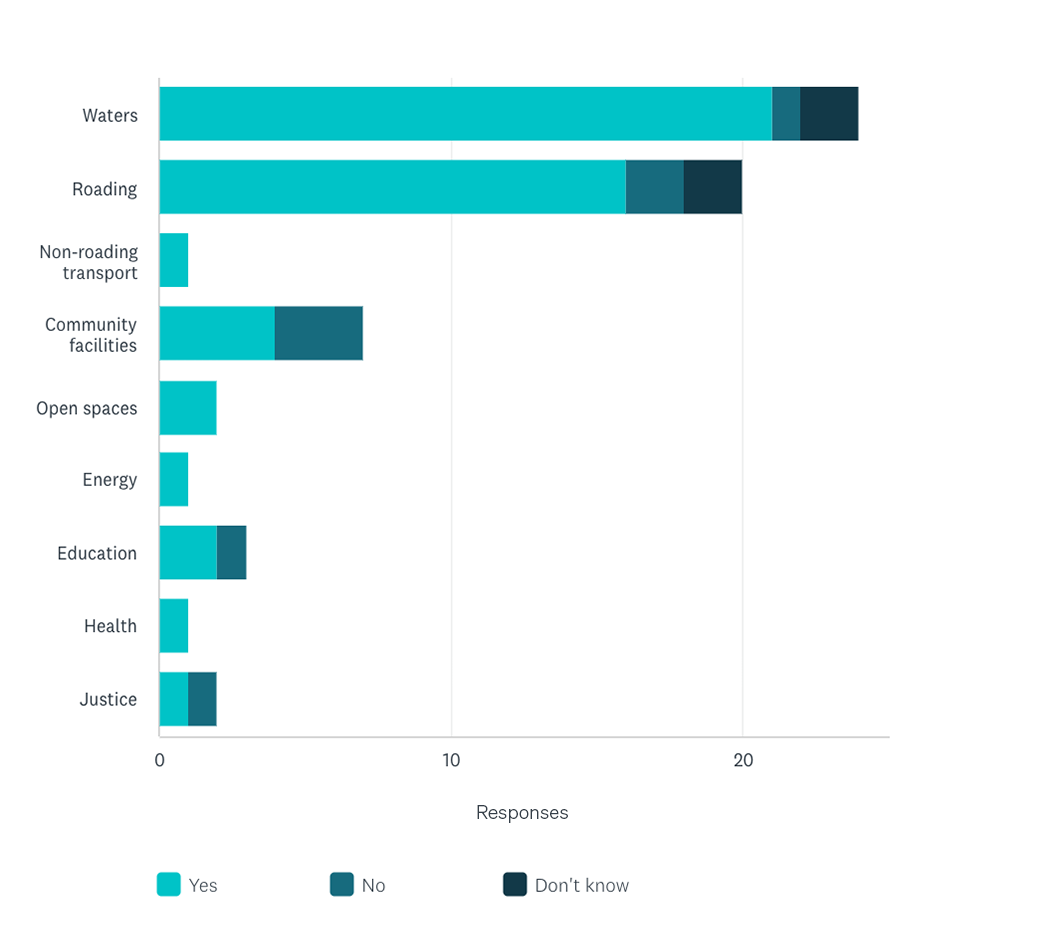

The questions asking about strategic and tactical capability returned similar results with only a few percent difference between them.

There is not seen to be enough capacity in tactical asset management, with 72% saying no and 17% saying yes, or strategic capabilities being 72% no, 15% yes.

Is there sufficient capability (ie capacity and competency) available to manage New Zealand’s infrastructure assets in strategic asset management (investment planning)?

Is there sufficient capability (ie capacity and competency) available to manage New Zealand’s infrastructure assets in tactical asset management (maintenance & operation)?

A majority of respondents, 54%, indicated the organisation they did most of their work for had a tier 2 executive accountable for asset management. However, 31% did not and 16% didn’t know.

Is a tier 2 executive accountable for asset management?

Most respondents (80%) have a longer-term plan for the infrastructure assets they work with. However 13% didn’t.

Does the organisation utilise longer-term plans to establish/guide investment decisions? E.g. an Asset Management Plan?

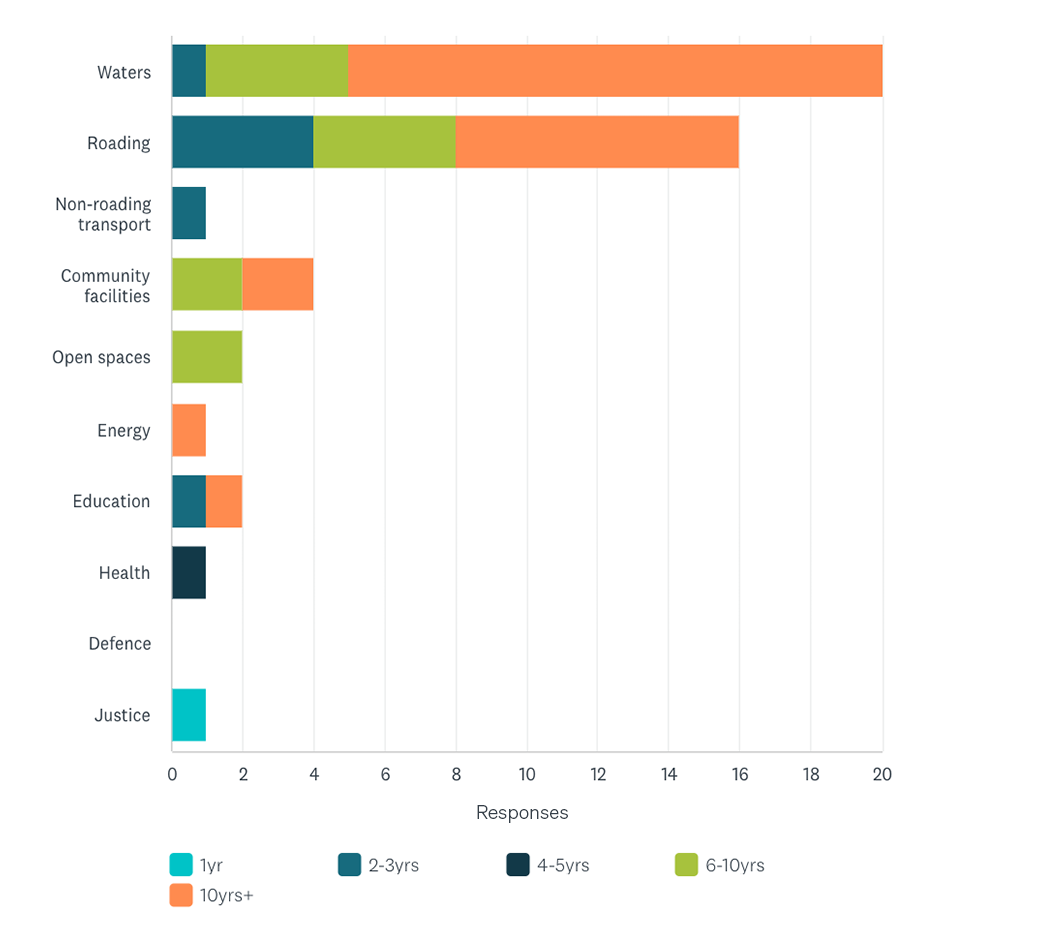

What period is forecast?

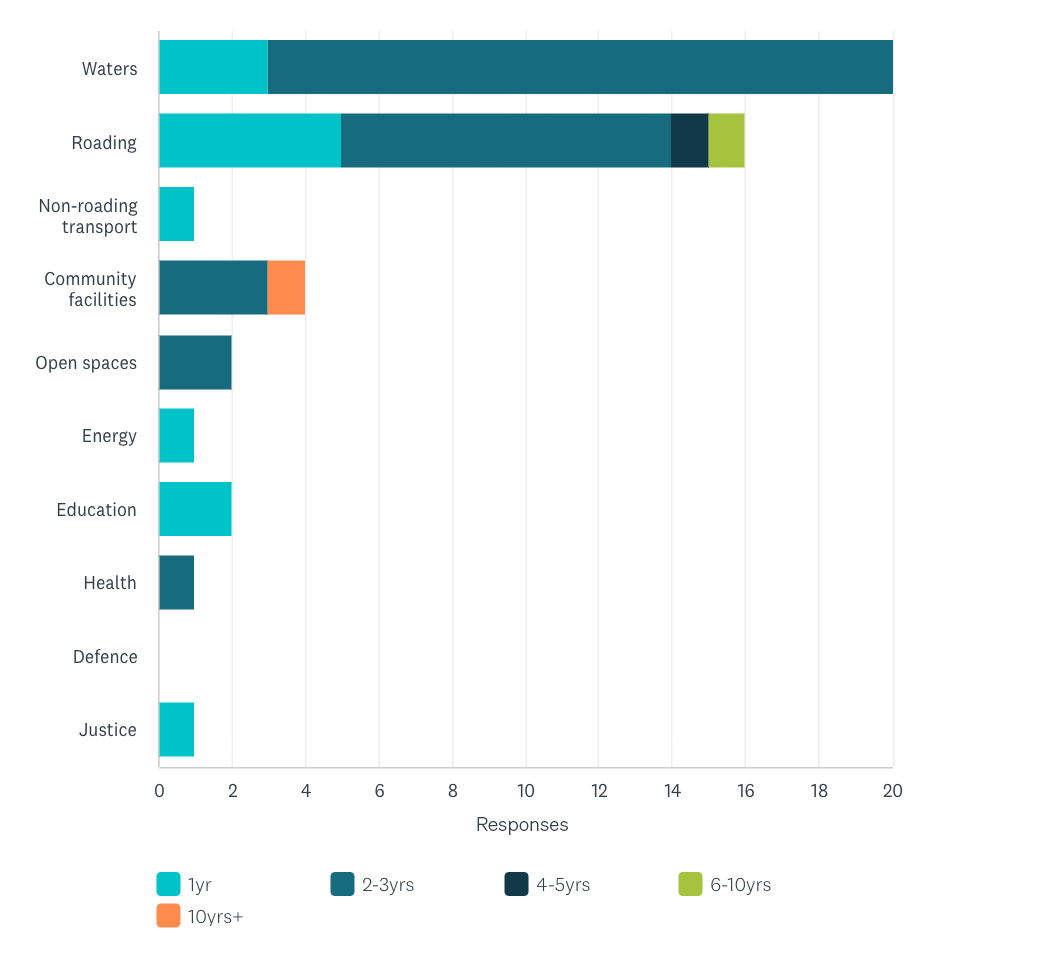

The forecast period of these longer-term plans were mostly more than 10 years. The water industry stood out with most respondents having plans of over 6 years. A 67% majority of respondents indicated that the longer-term plans are reviewed every 2-3 years, with 27% occurring every year. Longer review periods are uncommon.

What are the review periods?

This survey series will be completed quarterly – the next will be sent in February 2024.

3 thoughts on “Member Sentiment Survey #1 – the results are in”

Comments are closed.